Author: Dong Feng

Source: GPLP

After luckin coffee (LK. NASDAQ) crashed, Wall Street capital hunters Stared at Chinese education companies

On April 8, Good Future (TAL.NYSE) revealed that employees forged contracts and revenue, affected by this news, Good Future’s stock price fell 30% before the market.

This period is also a “sensitive period” of Chinese stocks. The negative impact of Good Future will soon be transmitted to another education platform With Whom To Learn (GSX.NYSE). , Compared with the previous trading day’s closing price of 32.45 US dollars/share,down 6.10%.

In February 2020, GRIZZLY REPORTS, a short-selling agency, released a short-selling report on whom to learn from, saying it exaggerated financial data and suspected connected transactions.

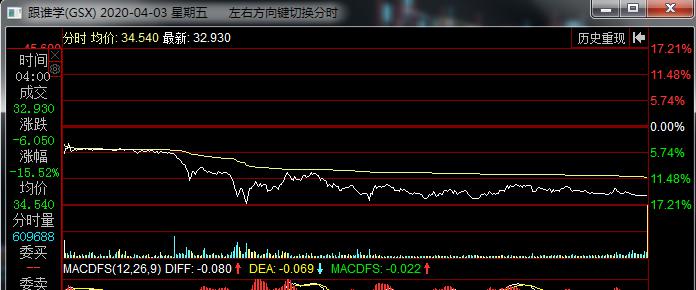

On April 3, the 2019 financial report released With Whom To Learn was very eye-catching. Its revenue in 2019 increased by more than 4 times year-on-year, and its net profit increased by more than 10 times.

However, the stock price began to fall continuously. In April 3rd, the stock price fell with more than 18%, who rebounded at the close, and finally closed down 15.52%.

Of course, the stock price of New Oriental and Good Future, which had been shorted, fell sharply in the short term, but in the long term the results are good. Will the shorted With Whom To Learn have a “Good future” like “New Oriental”?