Author:Sunny

Compile: Hanlu

Source: GPLP

On May 13, Dada Group submitted a prospectus to the American Stock Exchange (SEC), planning to list on the Nasdaq with “DADA” as the trading symbol, and tentatively raised 100 million dollars in IPO funds.

Founded in 2014, Dada Group is a local instant retail and distribution platform that has successively received investments from Sequoia, DST, JD, Wal-Mart and other strategic partners. Currently, Dada Group has two business platforms: Dada Express and JD Daojia.

Since entering 2020, the U.S. capital market has experienced fierce shocks, and the Chinese stock market has also been affected. However, Dada Group chose to go to the U.S. IPO at this time. What is the situation?

Dada Group is backed by JD.com and Wal-Mart to expand rapidly

In 2016, JD Daojia and Dada Express were merged into Dada Group. With JD Daojia and USD 200 million in cash, JD exchanged 47.4% of the shares of Dada Group and became the largest shareholder.

After the merger, Dada Group has many high-quality resources. In less than a year, it has won cooperation with 18 cities and 30,000 supermarket stores.

The data shows that as the largest shareholder from 2017 to 2019, the revenue contributed by JD accounted for 56.7%, 49.1%, and 50.5% of the net income of Dada Group, respectively, accounting for “half of the country”, which is the proportion in the first quarter of 2020 is 37.8%.

Retail giant Wal-Mart also participated in the investment of the merged “new Dada”, and directly connected Wal-Mart’s physical stores in China to JD Daojia, and Dada Express provided distribution services.

Data show that in 2018 and 2019, Wal-Mart contributed 4.6% and 13.0% of net income to Dada Group, respectively. In the first quarter of 2020, Wal-Mart contributed 14.9% of revenue to Dada, becoming the second largest customer after JD.

According to the prospectus, Dada Group’s largest shareholder is still JD, with a shareholding ratio of 51.4%; followed by Sequoia Capital, with a shareholding ratio of 11.4%; Wal-Mart is the third largest shareholder with a share holding ratio of 10.8%.

Three years of accumulated losses of 5 billion yuan with high operating costs

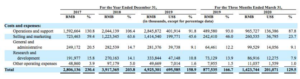

According to the prospectus, from 2017 to 2019, Dada Group’s operating revenues were 1.218 billion yuan, 1.922 billion yuan, and 3.1 billion yuan, respectively, and the income showed a growing trend.

However, the net profit of the Dada Group has shown a continuous large loss. From 2017 to 2019, Dada Group’s net losses were 1.449 billion yuan, 1.878 billion yuan, and 1.67 billion yuan, respectively, and the cumulative loss for the three years was about 5 billion yuan.

Why has the Dada Group experienced the phenomenon of “increasing income but not increasing profits” for three consecutive years? GPLP found that the key lies in its high cost.

According to the prospectus data, from 2017 to 2019, the total cost of Dada Group was 2.806 billion yuan, 3.917 billion yuan, and 4.925 billion yuan, respectively, and the cost was much higher than the operating income. Among them, the salaries and incentives paid to riders are the largest expenses. From 2017 to 2019, Dada Group’s expenses were 1.526 billion yuan, 1.918 billion yuan, and 2.6791 billion yuan, respectively.

However, according to the prospectus, in the first quarter of 2020, Dada Group’s operating income reached 1.1 billion yuan, and the revenue scale was one-third of 2019, which was close to the operating income of the whole year of 2017,due to the sharp increase.

At the same time, Dada Group’s cost expenditure has also grown rapidly. Data show that the total cost of Dada Group in the first quarter was 1.424 billion yuan, a year-on-year increase of 62.19%. Among them, the expenses paid to the rider’s salary and incentive measures are as high as 875.1 million yuan, nearly double the 457.9 million yuan in the same period of 2019.

In the first quarter of 2020, Dada Group’s revenue still cannot cover costs.