Author:Small sun

Compile:Azure

Source:GPLP

May 28, LAIX Inc.(LAIX.NYSE) released its first fiscal quarter report for 2020, claiming net income of 228 million yuan, a year-on-year decrease of 9.88%; a net loss of 197 million yuan, an increase of 192.85% year-on-year.

Regarding the decline in revenue and the expansion of losses, LAIX Inc. said that this is due to the tightening of sharing policies in the WeChat.

In May 2019, WeChat banned links leading users to share, LAIX Inc. to be named. WeChat has become a “back-boiler” of LAIX Inc.’s increasing losses. Is this really the case?

Loss becomes normal during four years

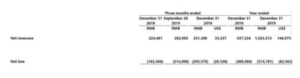

On April 17, LAIX Inc. said that it released its 2019 financial report and stated that it achieved revenue of 1.023 billion yuan, an increase of 60.6% year-on-year; a net loss of 575 million yuan, an increase of 17.77% year-on-year.

LAIX Inc.’s dilemma of increasing income but not increasing profit has already appeared. From 2016 to 2019, LAIX Inc.’s revenues were 12 million yuan, 166 million yuan, 637 million yuan, and 1.023 billion yuan; its net losses were 89 million yuan, 243 million yuan, 488 million yuan, and 575 million yuan, spectively. increase yearly.

Year-on-year growth in marketing costs directly catches up with revenue

LAIX Inc.’s marketing expenses are also increasing year by year. From 2016 to 2019, LAIX Inc.’s marketing expenses were 29 million yuan, 283 million yuan, 705 million yuan, and 969 million yuan. It can be seen that the marketing expenses in recent years are greater than or close to its revenue.

For a long time, LAIX Inc. has adopted the business model of “losing money for yelling”, investing huge marketing expenses in exchange for new users.

Spending money to get users is a normal strategy, but LAIX Inc. is facing the embarrassing situation of “can’t get users even though spending money”. LAIX Inc.’s growth of paying users has gradually stalled.

According to the first fiscal quarter report of 2020, as of March 31, 2020, LAIX Inc.’s cumulative number of registered users was 179.7 million, an increase of 45.62% year-on-year; the number of paying users in the first quarter exceeded 900,000, which was a decrease about 200,000 users from 1.1 million in the same period in 2019.

Some industry pointed out that the shrinking of the proportion of paying users indicates to a certain extent that the paid courses have little charm, low user recognition, and have not found new growth points to attract users.

Enter the more competitive children’s market

In May 2020, LAIX Inc.’s senior executives also changed, with Sun Bing as the chief financial officer (COO) and Zhang Min as an independent director of the board of directors.

LAIX Inc. tried to find new business models and directions through the adjustment of the organizational structure. In the financial report, LAIX Inc.’s CEO Wang Yi said, “Now our goal is to enter the children’s market.”

LAIX Inc. launched the children’s English spelling course and products pointing at children in 2019, and the user population was locked at 3-9 years old.

In this regard, Liu Zhang said that as a latecomer, if LAIX Inc. wants to take a slice of the soup in the children’s language training market, he must use a completely different business model and adopt innovative technological innovations to achieve transcendence.

LAIX Inc. is running online adult English as the main business, adult English has not yet achieved profitability, and began to enter the fiercely competitive field of children’s education. when will LAIX Inc. start to make money?