Author: Zheng Zheng

Source: GPLP

Meizu’s path has not been easy.

Meizu also has to survive in the gap.

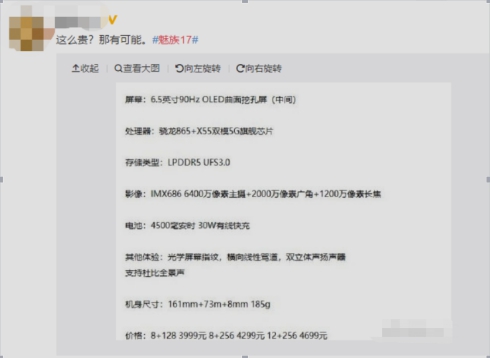

Recently, a digital blogger posted on the Weibo about the Meizu new model Meizu 17 related parameters information, the picture shows that Meizu 17 will be equipped with a 6.5-inch 90hz refresh rate curved hole screen, equipped with Snapdragon 865 dual-mode 5G chip and the current popular LPDDR5 and UFS3.0. At the same time, the aircraft also has a main camera for 64 million pixels of the horizontal three camera module, 8+128G starting memory version priced at 3999 yuan.

GPLP has sent a letter of inquiry to Meizu regarding the authenticity of this information, but has not yet received a reply. However, combined with Meizu official Weibo release of the news before, this information has some credibility.

On March 13, Meizu technology released a microblog, saying that in order to commemorate the 17th anniversary of Meizu’s founding, the team is making great efforts to build a new product with special significance — the 5G flagship mobile phone Meizu 17, which will be launched in April.

Now that April is coming up, information about meizu 17 could leak out.

If that’s true, the Meizu 17 doesn’t seem to have a clear advantage in terms of parameters and price compared to the models already released in 2020, so future sales may also be challenging.

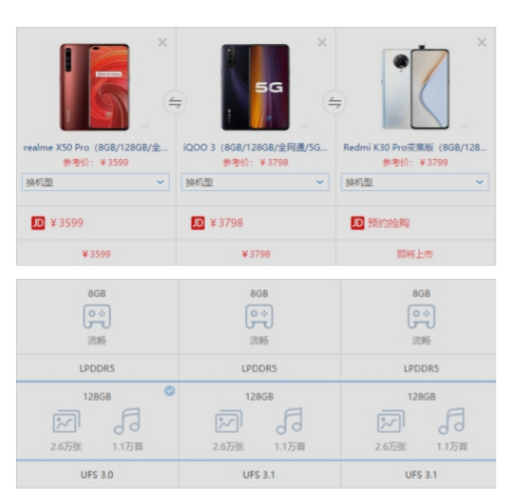

GPLP has learned that more than 70 5G terminal designs using the Snapdragon 865 have been released or are in development, according to Qualcomm’s official announcement. The more familiar models in the Chinese market include Realme X50 Pro, iQOO 3 and Redmi K30 Pro. The average price is similar to Meizu 17, which is about 4000 yuan.

Bsides, all of these phones have Meizu 17’s memory specifications and camera capabilities, and are even better than Meizu 17 in some parameters.

In addition to the configuration is not too attractive,Meizu 17 has a certain gap in brand influence with the above brands .

Realme X50 Pro, iQOO 3 and Redmi K30 Pro are owned by OPPO, VIVO and xiaomi respectively. In the third quarter of 2019, OPPO, VIVO and Xiaomi accounted for 16.6%, 18.3% and 9.8% of China’s smartphone market respectively, while Meizu Shared the remaining 5.1% market with many other smartphone brands, according to the data.

Thus it can be seen that Meizu 17 is slightly weak in terms of its own characteristics and the comprehensive strength of other brands. However, the specific situation will not know until the meizu 17 actual appearance.

In the future,GPLP will continue to pay attention to the market performance of Meizu.