Author:Helen Wang

Publisher: GPLP

PeiMin Zheng, who was in the US, once again had a smile on his face.

“Hello Mr. Billionaire” produced by Mahua FunAge tops the box office charts,naturally, as one of the Natural person shareholders, Zheng started his vacation with leisure.

However, in the current investment industry, the majority of investors hardly feel happy.

An inevitable fact is that in 2018, it is exceedingly hard to raise fund.

However, based on a series of well-performed projects like Mahua FunAge and Wishart Media, Shanghai Realize Investment has gained continuous support from the early LPs in the new phase of the new consumer fund.

“We had gone through countless twists and turns, which had costed us a fortune. However, we have been able to communicate with LP sincerely, and gained their understanding considering there were objective reasons. As a result, Realize Investment continued to review their cases, and finally found the feeling of investment, and successively invested a hot cake. Later, with the continued support of LP, the performance of our fund began to skyrocket. ”

How did they forge their way?

Reform in VC market is coming: GP and LP are upgrading their own consumption structure

A direct consequence of the difficulty of fund-raising is that China’s VC market reform is opening.

Zheng feels quite emphatic about this phenomenon.

“Truth of the difficult fund-raising in recent 3-6 month is that: first, the market as a whole is looming, while deleveraging is continuing. FOF is hard as well. Second, GPs are collectively exiting, which is hard while they run away from LPs, leading to the breakup with former LPs, ” Zheng admits.

Of course, in this case, in the investment industry, only a very small number of LPs will claim their rights. Most LPs, such as himself, will never invest this fund again. LPs are also upgrading their consumption and becoming more savvy. Although the money has been reduced a lot in the market, for some powerful LPs, they are not in lack of money. With the painful experience of a LP, Zheng made up his mind to be the GP that offers the best experience for LP after he established his fund company in 2015.

Zheng believes that GP’s return on investment for LP is divided into two types: one is the material return, which refers to the absolute financial return of the fund, and the other is spiritual enjoyment, including information disclosure in the fund management process, relationship maintenance and resource integration, etc., the two aspects of which complement each other and are indispensable.

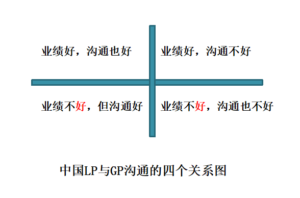

Realize Investment summed up four types of the relationship between Chinese GP and LP:

relationship between LP and GP

There is also an objective reason for the improper handling of the relationship between GP and LP. That is, with the development of the past decade, LP has become more mature. They bid farewell to the previous initial stage and gradually upgrade. If the investment behavior is counted as consumption, obviously the consumption of LP has been upgraded. As a GP, this cannot be ignored. In addition to the returns, the appeals of these LP investment in GPs appear more diversified than before.

“Financial returns, sometimes is not controlled by the will of the management, such as the pause or slow-down of the IPO, the economic crisis, the trade war started by President Trump, etc., the latter of which depends on the GP’s attitude, the most important among which is being trustful, respected and appreciated to LP. From the perspective of individual LP, whose money is earned by hard work as well and should be treated right by GP, ” Zheng said.

If entrepreneurship is a struggle of a group of bros, then investment is also a process in which LP and GP go through the dark and wait for the light. And usually LPs themselves have various resources, which would be very helpful as they do not mess up.

Realize Investment has determined to act according to the inspiration they draw from the current transformation.

“We invest in entertainment and the fields of consumption upgrades, many of which offer the offline experience. LP can make field survey, which provides a great experience. In addition, the process of the investment committee’s decision is open to the LP. Of course, only the members of the investment committee can make decisions. However, LP can clearly understand the entire process and logic of our investment, which would be always above board. ” Zheng said that although this is unimaginable for many funds., it is what Realize Investment strives for.

Annual meeting with invested enterprises to drink “Social wine” together

In addition, anniversary meetings of Realize Investment would invite their LPs and invested enterprises. If some LPs couldn’t make it due to various reasons, Peimin Zheng, the chairman of the board, will fly to report the performance, so that LPs really feel sincere and transparent regardless of the amount.

Historically, Realize Investment invested in each fund with a small scale, with an average amount of 3-5 billion yuan, but from the perspective of LP funding structure, portfolios including a number of listed companies and FOF make their LPs quite good. Of course, in 2018, the resistance to risk this winter of fund-raising is also higher. In a word, whether they are having difficult access to raise funds, they are always good enough to their LPs.

“Our second round fund-raising went smoothly, and the former LP’s repurchase rate exceeded my expectations. I am very touched by this, at least our sincerity is acknowledged by others.” Zheng, the memory of how difficult early fund-raising has always been refreshing. So no matter where the fund goes, Realize Investment still uses its actions to prove its efforts.

From Muhua Funage to Hello Mr. Billionaire: upgrading of VC 3.0 era

One of the reasons why Realize Investment dared to take the lead is that they keep moving forward, upgrading themselves in all aspects in VC 3.0 eras. Strength of Realize Investment is clearly shown through its successful investment including Mahua Funage, Wishart Media and Rucker Park, even comparable with top investment institutions. After they realized its potential and invested Mahua Funage, they have established industrial study from top to toe. In addition to their equity incentive service which stimulates the enterprises to grow to a good catch. Realize Investment is second to none in this aspect.

After experiencing the focus period of the exploration period, Realize Investment began to upgrade in the 3.0 era of consumption upgrade.

Take the understanding of investment as an example, Zheng would tell you with hesitancy that the core competence of being a GP is experienced and taking your lessons.

In the face of bloody experience and lessons, Realize Investment is more and more fearful of capital, and its investment style is more stable and focused.

This has much to do with the characters of Peimin Zheng.

On July 10, 2018, Realize Investment celebrated its 20th anniversary. As the earliest company to have equity incentive in China, Realize Investment still adheres to the traditional business of equity incentives.

As the founder of Realize Investment, Zheng likes to do everything with perseverance. Realize Investment, having been engaged in equity investment for 11 years, unswervingly adheres to a stable and focused, professional investment style, and maintains a high degree of awe of capital. “A GP investment style must be stable. The first is the ability to think independently, and the second is to focus, not affected by outside interference. ” Zheng observed that GP must have the ability to think independently before it can finally survive.

Perhaps many people perceive the cruelty of capital only after difficulty of fund-raising. However, in fact, many years ago, Peimin Zheng had experienced the emerge and bankruptcy of many funds. He had seen too many sectors with a greatest investment potential and institutional personnel who chase them, such as the Great Campaign for One Thousand Regiments and the PRE-IPO investment heat, in which institutions and entrepreneurs smashed and more capital behind them is also dying out. Therefore, in his view, GPs chasing hotspots are terrible, and all GPs must fear capital.

Realize Investment has an investment law, that is, if a project has more than five institutions to fight, then they will choose to give up.

Behind this is a reflection of the essence of an investment, that is, if a number of institutions go to grab a project, it will inevitably result in a very high value of the invested company, and whose founder will be easily lost. In addition, another aspect is that the investment institution lacks independent thinking.

“So when we think independently and focus on investment in a certain industry, we feel more calm than before, and we as investors shall restrain ourselves. ” Zheng introduced.

This is clearly shown in Realize Investment:

Towards invested enterprises, they told founders to focus on their business instead of their value and their entrepreneurship.

Cultural industry has steered into “the Red Sea”, which is preferred to be called new consumption industry by Realize Investment.

“The new consumption investment we define now refers to the upgrading of spiritual consumption, the production and circulation of all spiritual products and the technology industry that support the production and circulation of spiritual products. The cultural industry is a kind of consumption upgrade, not necessarily refers to film and television investment. It also includes sport, quality education, fashion industry, tourism and other sub-sectors.”

Of course, he insists that there is still statistics support behind the consumption upgrade investment. In 2015, the overall size of China’s entertainment industry has reached 450 billion yuan, and it is expected to reach 1 trillion yuan by 2020. Under the trillion market scale, the cultural industry will enter a period of skyrocketing development.

For example, even if Mahua Funage didn’t go public, Realize Investment would gain 300 or 400 millions dollars.

Instead of business mode, it is the essence of their business they truly value.

It is the growth of a company not simply the VAM that they value. As long as the company maintains normal growth, investors naturally have the possibility to withdraw.

“About withdrawal, in our perspective, it is natural to withdraw once the company keeps growing. The core in investment is to invest in growth. ” Zheng said.

Perhaps, this is what’s unique about Realize Investment and based on which they could stand out.

In the 3.0 era of VC, institutions must upgrade themselves completely.

Investment itself has not changed, but the understanding towards investment has been upgraded in all aspects.

For example, from the perspective of investment, Realize Investment basically only invests in projects of “unpopular” industry, and lays out the segment industry in advance, letting everyone chase them. In other words, lay out when others do not understand, invest what others can’t understand, and the investment ability of Realize Investment began to manifest itself.

A typical case is the investment in sport, the unpopular industry.

The sport industry in 2017 and 2018 has been going begging since the upset of LeSports.

The data show that since 2017, the entire sports industry has entered a period of calm thinking. The financing amount of the whole industry has dropped by more than 50% compared with 2016. All investors’ investment in the sports industry has become increasingly cautious and rational, and even some entertainment fund hardly invest in the sports industry.

At that time, Realize had gone against the trend, focusing much on sports industry. Zheng firmly believes that a sports industry would burst and sport stars may not be less valuable than movie stars.

“sport industry much resembled movie industry seven years ago, and emerges unicorn enterprises like Huayi Brothers Media Group and Enlight Media as well. At the time, we first founded Rucker Park, it only valued at 60 million yuan. Mahua Funage, which is in domestic sport industry, currently only values not more than 700 million yuan.” Rucker Parker creates an excellent stadium using the area of a business complex or traditional supermarket, providing customers with top facilities and services. No wonder it is such a hit. From Zheng, the founder of Realize Investment, being a web hottie in the investment industry is not happier than having many popular invested companies.

Realize selects the top among the excellent ones during the actual process of investment. For example, in the segment of sports+tourism, they had their own investment logic while possessing their features.

“In this segment of sport + tourism, we must invest in something that not only has the connotation, but also have natural landscape, such as Fuxian Lake in Yunnan. Many people may only know Dali, rather than there. However, through a triathlon event we invested in, we are likely to popularize this tourist attraction, because the people involved in this event are basically middle-to-high-end consumers, so we will bring popularity to this place. ”

It may be lonely to do things that others can not understand. However, this is the value of investors as a GP.

The decisions in mature period are more rational.

Like the old saying: “Everything is ready, only owe the east wind. ”

After all the upgrades, the most difficult investment decisions finally began to upgrade.

Being rational in an emotional culture industry, which has much to do with his character, Zheng is still in his way of exploration. Even he is doing the entertainment investment, he never chases the hot-spot, nor does he follow someone else blindly.

As everyone knows, Jun Lei has an investment habit. That is, “only invest in acquaintances.”

However, Zheng surprisingly adheres to his own judgement and never invests in acquaintances.

The rationale behind this conclusion is not to be an alternative in order to be alternative but draw from investment lessons of Zheng Peimin’s experience. “I may be more cautious when investing in acquaintances, because I know that many of my judgments may be affected by feelings and be confused by this feeling, so it is not easy to make a rational judgment of investment during decision-making. On the contrary, regarding strangers, we will be much more serious about the project. We feel that an investment is a business event. We don’t have to have any feelings. So we are more willing to contact strangers at a certain distance and observe him through various rational and emotional means. ” Zheng told GPLP that the decision on this investment was not easy.

If you don’t invest in acquaintances, investing millions or even tens of millions in a stranger who lacks trust is more or less a very risky thing.

How does Zheng select strangers and thus make, achievement?

It turns out that Zheng has his own Due Diligence system. Of course, this is also a process of constantly defeating human nature.

Perhaps, investment equals investing in people. During the course of defeating oneself and human nature, the seek of investment never ends.