Author:Yi Xian

After the death of William I, the founder of Great Britain, the country was divided in two, with the eldest and the second son inheriting the land on either side of the Channel. The fragmentation of national markets on both sides of the coast sets the stage for future generations: is Britain and France one or two countries?

It wasn’t until the fall of Calais in 1588 that Britain gave up all its pretensions to the French crown. And in the A-share plate, a similar story is playing out.

The emergence and end of two-headed governance

In March 2015, Dare Global, who made panels, and Power Dekor, who made floors, came together again through asset injection. The two valuable assets of the Chen family, which were divided between the eldest son and the youngest son, were consolidated under the listed company, and eventually formed the current listed company, Dare Power Dekor. However, in April 2015, the most worthy leader of Chen family——Mr. Chen, died of illness.

The original fragile resultant force of the listed company was interrupted again.The panels part are in the charge of younger brother Xiaolong Chen, and the floors part is in the charge of older brother Jianjun Chen.Though relatives in theory, the management inside the company is strange. Except for internal transactions of the substrate, the rest of the two parties do not affect each other.The development strategy of the whole group is proposed by Dare Global and Power Dekor respectively, and then decided by the group.

It’s a classic family style two-headed governance, and history has shown that this is not a permanent solution.

After the closing bell on July 18, 2018, the announcement by Dare Power Dekor came one after another.The family’s eldest son, Jianjun Chen, no longer holds positions at listed companies and has lost actual control of Power Dekor. Guhua Wu, the company’s vice President and secretary to the President resigned, and Xiao Chen no longer holds the board position. This means that the eldest son is completely out of business.

Interestingly, Dare Power Dekor brought in Midea ‘s Wenxin Wu, who was previously the deputy general manager of the air conditioning division of Midea group from April 1993 to January 2017, the President of domestic air conditioning division, the vice President, director and President of home air conditioning division of Midea group.

Since the success of Midea’s professional manager system, a number of former Midea employees have been working in different industries. For example, the model professional manager of home industry, Kuka, is also created by Donglai Li from Media.Today, the appointment of a former Media executive to head Dare Power Dekor is both a nod to professional managers and a possible prerequisite for the elder son’s departure

The two-headed management of Dare Power Dekor has come to an end. However, it is worth noting whether there will be any dimission of middle-level cadres in the future, for there are problems in the management of Dare Power Dekor. Even in its annual report, it hinted at the risks of controlling its subsidiaries.

The subsidiaries of the company’s wood-based panel business are located in Fuzhou, Jiangxi, Maoming, Guangdong and Zhaoqingand other regions, for which the company is under great pressure in organization and management.Due to the differences in the operation level of each region, if the company cannot ensure that the production and operation concept formulated by the company is implemented into the daily operation and production activities of each subsidiary, the operation efficiency and profitability of the company will be directly affected.

Several unanswered questions

There are several mysteries surrounding Dare Power Dekor all the time.

NO.1 What happened to Heilongjiang branch? When will the receivables come back?

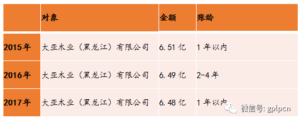

In 2015-2017, the house authority certificate of the factory and office building of Dare Wood (Heilongjiang) co., ltd. with a total value of 67.22 million yuan was not completed yet.Why hasn’t it been done in three years?Why can’t the loss-making enterprise take back 650 million yuan all the time?According to the account age, it can be reasonably speculated that maybe the subsidiary sends back the money before auditing at the end of the year, and then the parent company sends the money to the subsidiary after auditing. Why put 650 million yuan on the account of this loss-making enterprise?

NO.2 The growth rate of operating income and profit does not match

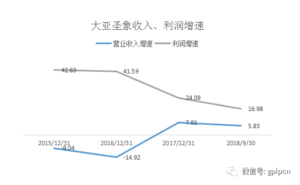

Since the restructuring in 2015, the company’s main business products have not changed, while the company’s profit growth is far faster than its revenue growth, which is unreasonable.If there is no price increase, how can profits grow much faster than revenues? Either the price of raw materials is lower, or the operating costs of enterprises such as administrative expenses are reduced.

In recent years, the price of raw materials has skyrocketed, for which the assumption of rising gross margins is not true. So, was it the result of a major overhaul of the company and a significant reduction in internal costs?

The facts do not support this hypothesis – data show that the combined costs of Dare Power Dekor continue to rise. This is suspicious.

In the third-quarter earnings report just released, the growth rate of Dare Power Dekor’s revenue deviated again, with revenue increasing slightly by 5.83 percent, while profit increased by 21.7 percent.Some argue that profits have risen because they have done a good job of keeping dealers’ equity in the company and giving the owners equity incentives.

However, all incentives are a cost, and incentives are best represented by increased revenues rather than reduced costs, so there is no way to explain Dare Power Dekor’s secret. Some people also pointed out that the abnormal performance of Dare Power Dekor is because the depreciation amortization has been completed, and the factory can still use it without mentioning the cost.However, the core factory of Dare Power Dekor has been collected by the government, and the company has received a one-time government subsidy, so the new production capacity needs to be depreciated.

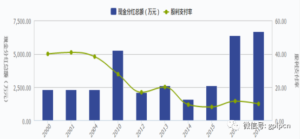

NO.3The dividend rate

Since 2014, the company’s dividend rate has been kept around 10%.Of course, the continued growth in absolute amounts is commendable. But why doesn’t the company divide the cash when there is no large investment in fixed assets?After all, the parent company is still eager for capital. Some of its shares are pledged and other industries need input. Dividend is actually good for major shareholders.

Conclusion

Recently, Power Dekor has started a battle of transportation at major transportation hubs across the country, with large-scale advertising.We expect that Dare Power Dekor, after years of on-again, off-again cooperation, will truly be able to “let the high-quality floor into thousands of family” under the new leadership.