Author:Qing Yi

Publisher:GPLP

“We can see that China’s market economy has past the best and are now in decline., with the stock market falling again and again. The glorious age of the Chinese people has passed. This is the worst as well as the best era. Only in the most difficult economic times can a company show whether it has the ability to lead the market.” ,said the chairman of Maccura Zhang Yong .

The rise of Maccura has been consistently hailed by the industry as an unicorn in the field of in vitro diagnosis.

Despite its pretty financial results, the 2018 semi-annual report released by Maccura(300463) shows that net profit attributable to shareholders of listed companies was 232m yuan in the first half, up 20.18 percent year-on-year.

This is not the case.

On DEC 18, 2017, Lu lei, a shareholder of Maccura, is condemned by the Shenzhen stock exchange for reducing his holdings which violating the prospectus’s pledge.

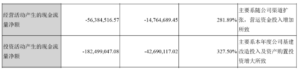

In the first half of 2018, the cash flow of business activities of Maccura showed negative growth, which plunged by 281.89% compared with the same period of last year. In the fierce market competition, Maccura is showing declining competitiveness of its main business and defects in its product business model.

An emerging industry: In vitro diagnostic industry

Many people may be unfamiliar with in vitro diagnosis.

In vitro diagnosis (IVD) means to obtain diagnostic information through in vitro detection of body fluids, tissues or cells and other samples collected, so as to judge diseases or metabolic functions of the body.

In general, in the examination of discharged patients, in vitro diagnosis exists as an important part of medical examination. In general, the main methods of in vitro diagnosis include biochemical diagnosis, immune diagnosis, molecular diagnosis, microbial diagnosis, blood diagnosis and other diagnostic methods. Among them, biochemical diagnosis and immunological diagnosis are the mainstream diagnosis methods with the fastest development speed and the largest proportion in China at present, accounting for nearly 60% of the whole in vitro diagnosis market.

Maccura is a company engaged in the in vitro diagnostic, one of its main product 300 speed light meter IS3000 – necessary equipment, which belongs to a kind of immune diagnosis that used for chemiluminescence technology. Nowadays, chemiluminescence technology has gradually completed the replacement of traditional immunological techniques such as enzyme immunity, which has become the mainstream of immunological diagnosis.

According to the data of Kalorama Information and Boston Medical, China’s per capital expenditure on in vitro diagnosis was $4.6 in 2016, only half of the world’s average level (in 2016, the global per capital expenditure on in vitro diagnosis was about $85), while developed countries such as Europe and the US reached $25. With reference to the development of mature overseas diagnostic market, the potential market size of in vitro diagnosis in China is 200 billion yuan.

According to the data in the blue book of China’s health industry (2016), the in vitro diagnosis market in China was about 43 billion yuan in 2016, which means there is still great room for development in the future. China’s economic level is developing rapidly, population aging and urbanization are intensifying, and the demand for downstream diagnosis is also increasing due to the enhancement of residents’ awareness of health care. With the support of domestic industrial policies, the diagnostic industry is expected to maintain an annual growth rate of nearly 20 percent in the next three years, and the overall scale of the industry is expected to reach 72.3 billion yuan by 2019.

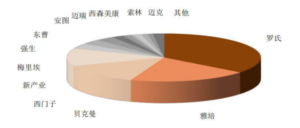

In terms of the market share in China, there are about 30,000 chemiluminescence devices in the market. Among them, the market of tertiary hospitals is mostly occupied by foreign enterprises. Local manufacturers that relying on the advantage of high cost performance turn to some tertiary hospitals and secondary hospitals with large human flow, while most other secondary hospitals and medical institutions are blank. Based on the demand of chemiluminescence devices in different grades of hospitals, it is estimated that the capacity of chemiluminescence devices in hospitals is nearly 50,000 sets, and the market space is about 27 billion. Considering the increase of samples from regional testing centers and primary medical institutions brought by graded diagnosis and treatment, it is estimated that the overall domestic chemiluminescence market is over 30 billion yuan, while the total revenue of each company is estimated that the domestic chemiluminescence market is about 17 billion yuan in 2016.

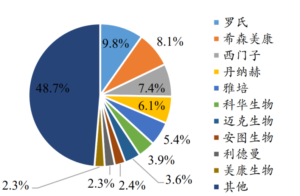

However, as the market gets bigger, competition is bound to get fiercer. In terms of the market competition pattern, China’s chemiluminescence market is still dominated by imported brands, with Roche, Abbott, beckman and Siemens alone accounting for more than 80% of the market share, while domestic manufacturers account for just over 10% of the market share, which is far from the domestic market share of 70% of biochemical diagnosis.

At the same time, due to the late start of in vitro diagnosis, most of the in vitro diagnosis market in China is monopolized by foreign giants. The top five are all overseas companies (the data is the statistics of 2015).

Source:EvaluateMedTech

市场规模:market size ( in 100million yuan)

同比:on year-on-year basis

Can Maccura stand out?

Maccura‘s annoyance: the waves keep coming after listing

In May 2015, Maccura successfully landed on the Shenzhen stock exchange.

After the listing, however, Maccura has been lurched from crisis to crisis.

In July 2016, Maccura was revealed to have falsified clinical data. According to the notice issued by CFDA (2016), the administration organized the first batch of clinical trial supervision and sampling inspection of medical devices in July 2016. Maccura’s hepatitis b virus e-antigen assay kit (chemiluminescence) was found to have problems with the authenticity of clinical trial data, and was given a penalty that cannot be registered and will not be accepted again within a year.

In October 2016, Maccura announced the resignation of the secretary and supervisor of the company.

The incident raised questions among Maccura investors: “how do you feel about the CFDA’s announcement of corporate fraud? Does the company have the same problem with other products? Does the company have integrity?” “Why do companies cheat when they register their products?” “Is the company’s performance as fake as the product?”

Maccura’s troubles are not over yet – on December 18, 2017, Maccura’s shareholder Lu lei was reprimanded by the shenzhen stock exchange for violating the prospectus’s pledge to reduce his holdings.

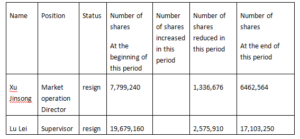

According to the data, Lu lei sold his holdings three times on June 28, July 13 and September 5, 2016, with a total of 3 million shares reduced. The available limit has been used up . On Jan 23, Jan 26, Feb 7 and Feb 8, 2017, Lu lei reduced his holdings by another four times, totaling 3 million shares, and was condemned by the shenzhen stock exchange for violating his commitment.

Source: Semi-annual Report of First Half 2018

Among the list of holdings reported in mid-2018, Lu lei reduced his holdings by 2.57 million shares, and Xu Jinsong reduced his holdings by 1.33 million shares.

Source: company announcement

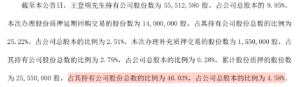

According to a notice released by Maccura on August 2, the pledged shares of Wang Dengming, the major shareholder of the company, account for half of his holdings. However, as the largest shareholder, Is the purpose of this additional pledge by Wang Dengming an additional enterprise cash flow? We don’t know.

But the strange thing is, on the one hand, large shareholders secret underweight.On the other hand, on November 7, 2017, according to the announcement of Maccura, 2017 to November 7, 2017, the shares held by persons acting in concert Tang Yong, Guo Lei, Wang Dengming, Liu Qilin has accumulated 4,182,621 shares of the company through concentrated bidding in the secondary market, accounting for 0.75% of the total shares of the company, with the increased amount of about 103,280,637.00 yuan.

In vitro diagnosis of listed company index (source: Wind)

No one knows exactly what tricks Maccura is playing.

The 2018 semi-annual report released by Maccura in July 2018 showed that the company achieved operating revenue of 1.246 billion yuan in the first half of 2018, up 47.82 percent year-on-year, and achieved net profit of 231 million yuan belonging to the owner of the parent company, up 20.18 percent year-on-year. Earnings appear to have increased, as well as being a dark horse in the extracorporeal diagnosis industry.

Source: semi-annual report of 2018

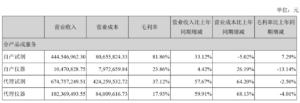

According to the 2018 semi-annual report, the growth of Maccura’s performance is mainly attributed to the sustained and rapid growth of agent products and self-produced products brought by market initiatives such as channel extension expansion and continuous promotion of new business model. The sales revenue of agent products increased by 57.96% year-on-year and the sales revenue of self-produced products increased by 32.28% year-on-year.

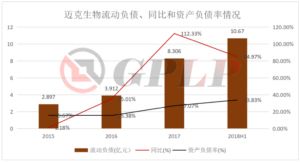

The gross profit rate of Maccura’s self-produced reagent and self-produced instrument was 81.86% and 23.86% , respectively higher than the 37.13% and 17.93% of the agent’s reagent and agent instrument, among which the gross profit rate difference of reagent was about 45 percentage, showing a significant advantage. But its revenue share has reversed. The agency products account for 62% of the revenue, indicating that the market advantage of the self-produced products of Maccura is replaced by the agency products, and the income is constantly declining, while the debt situation is constantly rising. Data shows that the total amount of current complex debt increase of the semi-annual report of Maccura in 2018 has exceeded that of 2017, and the asset-liability ratio is also increasing with the expansion.

The self-developed products of Maccura are not as competitive as the agent products in the market. In this case, Maccura still develops through the continuous expansion channel. However, the liabilities are also constantly increasing, with the negative cash flow as well as the increasing danger:

Source: CNII

In terms of cash flow, Maccura’s free cash flow has been continuously negative. It is obviously not wise to sacrifice cash flow while expanding channels. After all, cash flow is the blood of enterprise operation. Once the cash flows have trouble, then the enterprise would get into trouble more or less.

Source: semi-annual report for 2018

Eventually, Maccura’s revenue power began to decline. In addition, due to the expansion of the company’s channels and the increase of working capital input, the cash flow of the company’s operating activities in the current period showed a negative growth, which plunged by 281.89% compared with the same period last year. Although the company had a remarkable achievement in the revenue performance, it neglected the continuous decline of its main business competitiveness and defects in the product business model.

Source: Wind

In a sunrise industry, a company that has been on the market for only three years is not growing as fast as before. Why?

What’s wrong with Maccura?

Only when the craze is over can we see the reality clearly

With the rapid development of in vitro diagnosis industry, Maccura has fully obtained the dividends of this industry.

Arguably, the past decade has been a period of rapid development for Maccura.

In the new cycle of health-care expansion that began in 2009, Maccura grew up with the extracorporeal diagnosis industry. At that time, the domestic substitutions of biochemical reagents were rapidly accelerated. Under the strong demand of import substitutions and the special background of opening biochemical reagents without binding devices, a number of similar in vitro diagnostic companies were born from 2008 to 2009. At that time, the research and development investment of 5-10 million yuan could generate tens of millions of profits, and even the net profit of a company could be as high as 30-40 million yuan if the revenue was over 100 million. Maccura is one of the many entrepreneurs who have flooded into the industry with high gross margins and powerful money-making effects.

However, after a decade of rapid growth, the era of making money in the extracorporeal diagnosis industry is coming to an end. As the industry enters the stage of disorderly competition, only those enterprises who decide to transform in the stage of rapid development, increase research and development and develop products in the period of safety and crisis can flourish in the stage of comprehensive development in the future. Maccura, however, missed the opportunity.

Currently, in the two largest plates of in vitro diagnosis, biochemical + immunity (over 90% of immunity is luminescence) is the guarantee for the greater development of in vitro diagnosis companies. At present, the domestic substitute rate is high, while the luminous products are just starting. The brand synergy brought by complete products is more and more prominent. Among them, chemiluminescence, in particular, has a high entry threshold and a high expectation for performance realization. Therefore, companies with chemiluminescence products and a large scale will have an advantage in future competition, which is also one of the core competitiveness of the company.

According to the data, the production of luminescence instruments is very difficult, for which imported brands have monopolized in China market for more than 10 years before the first domestic one was made. The threshold of luminescence instrument is not something that ordinary products can cross. For example, the threshold of luminescence instrument includes capital, technology, registration and the company’s understanding of clinical. In fact, it is the easiest part to obtain the production qualification certificate. It’s relatively easy for the product to go from zero to 60-70, but it takes 80 to 90 points to meet the clinical needs. The distance of 20 points may take 20 years to complete, but most of the domestic luminescence products are still in the state of 50 points. Therefore, in this market segment of China, there are mainly a number of foreign enterprises competing for market share. Chinese enterprises take up a small proportion in the domestic market, and there is a lack of leading players. Most of the market is still occupied by foreign manufacturers represented by Roche.

Market share of chemiluminescence

Maccura is also one of them. Even if it has been successfully listed, it still lacks core competitiveness in the competition of in vitro diagnosis follow-up, and it is obviously reasonable to have a series of troubles in the future.

In a word, the title of unicorn of in vitro diagnosis for Maccura is a bit more in name than reality.