Author: Yi Qing

Publiser: GPLP

As Warren Buffett says, it’s only when the tide goes out that you know who is swimming naked.

This is the case in the new energy vehicle market in 2018. When the national subsidy in 2017 fell back, the real situation of the entire new energy vehicle market industry chain was exposed to us: fraudulent compensation, low technological content, overcapacity and fierce competition. There is no doubt that 2018 is a reshuffle year. What is the current situation of the new energy auto industry market, and what are the investment opportunities?

On September 1st, 2018, sponsored by GPLP, the first media in the venture capital industry, the New Energy Industry Investment Roundtable co-host by China Investment Security was successfully held in Beijing. Let’s listen to what the investment big shots and analysts have presented.

CITIC Capital Investment Vice President & Chief Researcher, GaoYun

Mr. Gao focuses on equity investment in the new energy automobile industry chain and completed investment in 7 related industrial chain projects, including the industry unicorn enterprise CATL(300750), the global anode material leader BTR(835185), etc..The cumulative investment amount is around 4.5 billion yuan.

His main points are as follows:

(1) In the field of power batteries, lithium-ion batteries have significantly better overall performance than lead-acid batteries, nickel-hydrogen batteries and hydrogen fuel cells, and will remain in the mainstream for the next 10 years. Since entering the orderly development stage in 2016, it will maintain a growth rate of around 30% per year, and the market potential is huge.

(2) In the market segment, the ternary battery used for pure electric passenger cars is the main development trend, and lithium iron phosphate batteries have opportunities in the energy storage field; soft pack batteries have great development potential due to strong safety performance.

(3) In the whole industry chain, the era of “resources are kings” gradually recedes, and all links will gradually enter the stage of rational development, and the profit level will gradually level off.

(4) The cost of power battery will be further reduced in the future. The main driving force comes from the decline of raw material prices, large-scale production, modularization of products, improvement of energy density and yield, utilization of cascade recycling.

(5) The local automakers of the downstream automakers, although the current power battery industry has a high degree of concentration, but in the future to ensure product and strategic safety, will actively train the second and third supply and other manufacturers, thus allowing at least five companies in the industry to enjoy high speed growing market.

(6) In the future, customer-oriented companies with good genetics and heritage,, and technology and product safety will be more likely to win.

CICC Electrical Equipment and New Energy Analyst, Liling Song

Her main points are as follows:

(1) New energy vehicles benefit form the short-term subsidy policy, while in the long run it will benefit from the “dual points” policy.

(2) The subsidy policy has continuity and is expected to last for 2-3 years. The orderly decrease of subsidy will not affect the development of the industry.

(3) In the case of fundamental improvement, most companies in the industry chain have reached a low valuation. The power lithium battery shuffling accelerated. In 2017, the number of effective installed manufacturers was reduced from 109 to 80. In the first half of 2018, the number was reduced from 80 to 50, and the market concentration was further improved.

(4) Ternary lithium battery has become the mainstream of power lithium battery development, and high-nickel ternary and soft-pack batteries have become a clear technology development trend.

(5) At present, the industry’s diaphragm segment has the highest gross profit margin (more than 60%), and the price can be reduced. It will be the main force for reducing the cost of lithium battery materials in 2018.

(6) In 2017, the electrolyte capacity is already over-capacity, which is a formula product that is difficult to develop and easy to produce. The core competitiveness of the electrolyte manufacturer in 2018 lies in the independent research and development of the independent production and additives of lithium iron phosphate.

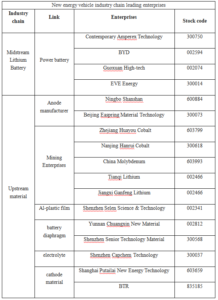

Appendix: New energy vehicle industry chain leading enterprises list