Author:Xing Mo

There is a phenomenon in the investment industry:

E-commerce projects claiming “our team comes from BAT” are mainly Baidu’s people, while the social media and financial ones come from Alibaba and Tencent respectively.

what’s the reason for that?

This involves an open secret that is taken in whatever you need for both people and the company.

Every company has its own halo.

For example, why people from Alibaba can be so active in O2O and unmanned shelves. Why is the iron army of Ali so famous? It’s because Alibaba is a company that started from an e-commerce platform so in normal times the Ali people are trained to be masters of sales promotion, and for Tencent, it is a company with social gene and gaming gene.

For example, a former Facebook executive cashed out and then bought Amazon’s secondary market stocks after his resignation . He once publicly stated that the Facebook model is easy to be subverted by competitors, while Amazon is different.

It’s also reflected in the process of Tencent’s investment.

As of August 1, Tencent has invested in 93 companies in 2018, with an investment scale of 187.472 billion yuan. In the first half of 2018, social e-commerce was a highlight of Tencent’s investment.

Statistics also show that in 2016 and 2017, Tencent invested 85 and 113 respectively, ranking second in the world.

Tencent is an investment company, no doubt, and more and more like a professional financial investor. In the future, will Tencent Investment become a professional investment institution and a competitor for other investors?

CVC or financial investor?

The difference between CVC and traditional VC lies in that CVC investment mainly focuses on the company business that it relies on, with the investment field generally limited within a certain business scope.

In any case, Tencent’s investment still belongs to the category of CVC. However, in recent years, VC investors, who regarded Tencent as the receivers, have now felt the threat of Tencent. Tencent is more and more like a financial investor, rather than just a CVC.

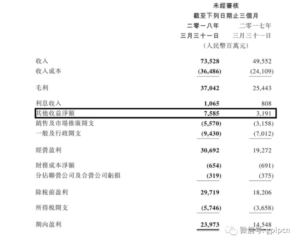

According to the first quarter earnings report released by Tencent Holdings as of March 31, Tencent’s revenue for the first quarter was 73.528 billion yuan (11.693 billion dollars), representing a year-on-year increase of 48%; the profit for the period was 23.973 billion yuan($3.812 billion), a year-on-year increase of 65%.

Among them, a 137.7% growth rate of other net income is regarded as the main reason for the rapid growth of net profit.

Looking at the net income of other income, it can be found that the proceeds from the disposal and deemed disposal of the investment company (1.572 billion yuan), plus the fair value of the financial assets measured at fair value through profit or loss (6.04 billion yuan) has reached 7.614 billion yuan, compared with 2.728 billion yuan in the same period last year.

Clearly, the investment made by Tencent has paid off.

According to the financial statements of Tencent Group over the years, Tencent’s other net income in 2017 was 20.14 billion yuan, a significant increase from the 3.954 billion yuan in 2016, which is equivalent to nearly half of Tencent’s advertising business revenue, mainly because Yixin Group, Zhongan Insurance, Sogou and other companies listed last year, as well as their investment in projects such as sharing bicycles and medical care. Net other income mainly reflects the net disposal of Tencent’s external investment and the gains and losses from changes in fair value. Zhiping Liu, president of Tencent, once revealed at the annual meeting of Tencent Investment that the added value of Tencent’s investment in the early 2018 has exceeded the market value of Tencent itself.

Regarding the scope of Tencent’s investment, it has not limited itself in social media and game, which are their main business, instead, they covered a whole range from transportation to online education, from AI technology to new retail. Following the definition of CVC above, Tencent Investment is more like a financial investor.

Is good or bad that Tencent has invested in another way?

It involves the secrets of CVC.

From CBinsight statistics, the total capital invested by CVC increased to a record high. In 2017, these companies invested more than $31 billion in private market funds in 1,791 disclosed equity transactions.

In general, CVC strategic investments have two main purposes, one is potential acquisition opportunities, and the other is to understand the industry’s latest technology.

Of course, Tencent is not the first company to make CVC investment, with the earliest being Microsoft, followed by Qualcomm, and the more active ones like Google and Facebook, which are generally business-oriented. Of course, in China, Tencent’s Competitor Ali has also been investing and making M&A with its core business in mind.

Nowadays, investors are fiercely competitive and there are few entrepreneurs. The most important reason is not only the increasing fund, as well as the increasing willingness of startups to get CVC funds, but also that CVC can provide more industry support, which empowers the invested company effectively. Ordinary financial investors have no easy access to that. Picturing a $3 billion fund that may manage 100 to 200 projects, due to the limited energy investors have, how could they really offer the post-investment management they promised?

Only Tencent has changed more thoroughly, and its investment has expanded from those related to a main business to the ones in other industries.

For Tencent, why is this change happening?

The writer thinks this has much to do with the order competing environment, which is essentially the fight over traffic, not only the stock traffic but also offline traffic like Mobike.

Secondly, this is related to Tencent’s company gene.

As it is widely known, Tencent is a company focusing on social intercourse.

The social platform is characterized by network effect and platform effect. When the user reaches a certain level, the platform enters exponential growth, and more users rely on existing users to attract new users. The threshold of social companies is quite high, because the first batch of users are very difficult to accumulate, but once they have this batch of users, their user scale will grow rapidly, and the number of users, that is, registered users, has become the moat of the company. If these registered users are used more effectively, let them kill more time on the platform. More daily active users, the greater the chances of commercialization later.

The pros and cons come hand in hand.

What are the disadvantages?

What is the most tested of social companies is product capability and operational capability. Compared with e-commerce, logistics, AI and other industries, the threshold of social industry is relatively low. In short, it is easy to attack while hard to defend.

Take Wechat as an example, it was born out of a awareness of crisis—In 2010, in the first year of the mobile Internet era, Xiaomi developed a chat software Michat, whose users grew very fast, but in just one month, Tencent launched WeChat, with more than 800 million users. It is the result ofTencent’s internal competition for three products. Tencent also got its first ticket of mobile Internet. Some of this internal competition stemmed from its anxiety.

Nowadays, when the growth rate of WeChat is beginning to decline.Tencent’s anxiety has been increasing, because the biggest shortcoming of social products is being abandoned by young people, but in many cases this is inevitable. The biggest product of social product management is people, but with the demographic structure and inter-generational changes, social products will also face the situation, just like the song “When you are old” that Tan Weiwei sang. Social products are the biggest cornerstone of all of Tencent’s profitable products, so this anxiety is innate.

During the course of the development of Tencent, this kind of danger is all along the way:

I still remember the story that Tencent didn’t invest in of YY and Momo before? In 2010, Tencent wanted to invest 150 million dollars to acquire YY and give 40% of the founder XuelingLi, but Li did not accept it. In the following year, Tencent launched its own QQ TALK, and terminated the cooperation with YY. This is similar to the development of the current “Headlines Today vs. Tencent battle.” Tencent, which is good at making products, did not make QQ Talk work. Surprisingly, in 2012, YY went public on NASDAQ.

The story of Tencent and Momo needs to introduce the third protagonist – Alibaba. Momo was founded in the era of mobile internet. At present, the market value is among the top ten Chinese concept stocks. As a social platform for strangers, Momo has obtained investment from Alibaba and YF Fund. Both have a common competitor.Tencent. Alibaba, who wants to make social products but never succeed, understands that the foe of the enemy is a friend. Momo is also listed on the NASDAQ with the support of investment institutions such as Alibaba.

The first story shows that missing a project that may be a super unicorn in the future, such as YY or Headlines Today, may have an impact on the future Tencent business. On the other hand, it also shows that Tencent also has its scope if capabilities—they are not a master of everything.

The second story shows another feature of CVC investment, slamming opponents. Since Ali is not good at social products, it invests in Momo to compete with Tencent in the social field. On the other hand, Tencent does not perform well in e-commerce, then it will focus on supporting JD and Vipshop. In fact, the two sides have been asphyxiating of each other’s business for a long time, but they can’t really make a breakthrough in the core business of the other party. So what should they do? Like playing chess, Tencent plays the role of a general in the battlefield, directs the agent, and delivers enough ammunition for the agent. The ammunition bag may contain traffic, funds, or other resources.

The author thinks of a saying, the more a person emphasizes something, it shows that the more he or she lacks. When Tencent emphasizes that it is younger, you can see that the growth rate of active users of 19-year-old QQ products has declined. The growing Tencent investment has been significantly different from Alibaba’s investment style.

This is related to the history of Tencent. Because Tencent has experienced the 3Q war, this fierce battle has made Tencent more aware of its own genes. As the upper end of the traffic, traffic can be used as a connection point with the entrepreneurial ecology, without the need to theusual capital holding.

Therefore, why Tencent said that it is willing to be a connector, because Tencent is a traffic engine in the past the Internet and the current mobile Internet era, but the engine is not equal to perpetual motion.

Therefore, once Tencent’s investment is born, their goal is to establish the industrial ecology, just like the style of Google venture, while Alibaba is different. The e-commerce platform needs a stronger relationship. The most typical one is the Green Hand logistics platform. The logistics companies that have settled including one that has been interviewed by GPLP who is a founder of a crowd-sourcing platform company. His view is that the more participating investment, the more resources are given.

In a word, Tencent needs to transfer its own anxiety through investment. Therefore, under various objective reasons, Tencent’s investment transformation is more thorough.

Would Tencent transform into an investment company?

Although Tencent Investment is still a CVC company, it does not rule out this possibility of an investment company.

Because Tencent has been anxious.

In the United States, there may be only a few companies in the areas of transportation, take-out, etc. The competition will not be as cruel as in China. In the early days, if there were 4-5 companies in the industry, there would be no new entrants, they would choose other opportunities instead. It is different in China. Even if you have become a big company in your game, you must guard against competitors coming from nowhere.

You know, as a listed company whose market value has reached nearly 3.8 billion HKD, missing is far more serious than making mistakes. Missing may be the loss of tens of millions or hundreds of millions of dollars, but if you miss the next vent, the damage that can be caused is not just hundreds of millions of dollars, it may be the decline of the entire market value and strategic level mistakes.

So why can Tencent Investment invest like a financial investor and participate in a small percentage without holding shares?

First of all, Tencent is a huge aircraft carrier. There are costs for trial and error of new things. It is often difficult to coordinate internally. It is more economical to give it to other companies to do it. For companies that have already grown up to be helpful to Tencent’s strategy, Tencent can form a deep bond with the invested company through traffic, without the need for holding shares.

Tencent is the second largest shareholder of Jingdong. After Jingdong enters WeChat, a large part of its business traffic comes from the system of WeChat. In the past, a large part of the microfilm gained customers because of the system of Tencent.

The boom of PDD also partly stems from the support of Wechat. These companies themselves rely on Tencent considerably, This is somewhat similar to the current relationship between Xiaomi Investment and Xiaomi’s ecological chain.

Take a look at the current Meituan and Headlines Today. The biggest threat to any Internet company is not from peers, but from the intrusion of new species. After the acquisition of Cabbies and outsider Uber, Didi thought it could dominate the transportation industry of the country. It did not expect the Meituan killing from the field of take-out, and to take a share in the taxi market. Everyone thought that Headlines Today is a media. Later, Headlines Today gradually opened up their own content, cutting from the perspective of information flow, and launched TikTok(which is referred to as “douyin” in Chinese), and has become short video platform with a daily user of 150 million. Headlines Today has recently announced that it will start selling goods on TikTok, opening up new e-commerce business.

In addition, why wouldn’t Tencent turn itself into an investment company?

Softbank is Tencent’s role model.

Softbank, a company started with telecommunications, has invested in companies such as Alibaba,Yahoo America, and ARM in the past, and its investment in Alibaba has contributed most of the profits to Softbank.

In the latest disclosure, Softbank said the company is transforming from a telecommunications company to a strategic holding company. In 2017, the company raised the first phase of the 960 billion dollars vision fund with a 12-year investment cycles and is by far the world’s largest private equity fund. It is said that in the past, it has invested more than 30 billion dollars, and has invested in Uber and Grab in the field of travel transportation, and tried to influence the M&A in this field.

Will the direction of Tencent in the future be similar to that of the Softbank Group?

Personally, GPLP believes that the future, like Tencent, investment after the development of existing industries will become the trend of the times, such as the recent unicorn company Nio and Nio Capital, and the more active ones like Headlines Today and its investment, as this phenomenon is becoming more and more common among Internet companies, GPLP believes that it cannot be regarded as the main business income only by the source of operating income exceeding 60%, but should adopt the new evaluation criteria to judge its core business driving force. For example, if Tencent is based upon a platform of infrastructure like water and electricity, it is not impossible to continue to develop through investment and flow in the form of a large ecosystem.

A typical fact is that Tencent Investment has recently started to raise funds abroad and started operating independently like Sequoia and Hillhouse Capital Group.

Only that in the investment industry, how could investors of VC institutions react facing competitors like Tencent?

It is a puzzle waiting to be solved.